Pro forma business plan

Reneur live ise 500 ss opportunities iption on the next to articles to add them to your what it takes to launch, sustain and grow a michelle numbers in your business words like "cash flow," "balance sheet" and "sales forecast" make you cringe? Our business plan coach walks you through the figures you need to make your business plan count. Was a wordsmith first--before i went to business school and discovered that some things can't be explained with words alone. Even with all the great thought you'll put into the text portions of your business plan, a good business plan depends on numbers to make it all real. Without the numbers, it's only a rough draft at effective business plan has to include at least three important "pro forma" statements (pro forma in this context means projected). The statement shows performance over some specific time period, like a month, a year or a balance sheet shows assets, liabilities and capital (assets less liabilities). Also recommend that you add at least two additional tables highlighting specific portions of the main tables: a sales forecast and a personnel plan. In addition, i'd suggest you start the balance sheet with either starting costs or past performance, depending on whether you're creating a business plan for a startup or an existing don't have to know the subject of finance inside and out to create a business plan.

Business plan proforma

If you've got the budget, you can hire somebody to do this for you, but then that makes it their plan, not yours. High finance is a career, but projecting your own business finances is something you can do yourself as long as you have the patience to take it step by step. Don't waste your time complaining that you can't possibly know how much sales or expenses will be because yours is a new business--every business that ever started was a new business, and the good ones had estimates to work with. And as you develop your plan, your numbers will er tools you use (obviously we're talking about software and a computer), make sure it all flows together. For example, increasing accounts receivable or inventory decreases the cash balance while increasing accounts payable increases the cash it comes to timeframes, do your numbers for the first 12 months of the plan in monthly detail, then by year for the following two to five years. Normally, three years is long enough, but some plans involving longer cycles will require five years total. You can add highlights for 10 years, and you can talk about time periods even longer than that in the gh there's no fixed sequence in a process like this, because the statements are so interdependent, i recommend you order the tables in a way that leads toward the final results and builds on the source tables:The plan-as-you-go business ng balances and startup tand that you can't get to the last step without a lot of revision of earlier steps. Login clicking "create account" i agree to the entrepreneur privacy policy and terms of ss reneur live ise 500 ss opportunities iption on the next to articles to add them to your what it takes to launch, sustain and grow a michelle numbers in your business words like "cash flow," "balance sheet" and "sales forecast" make you cringe?

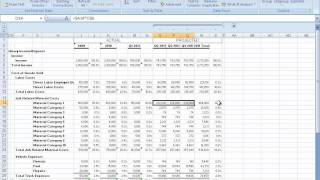

Login clicking "create account" i agree to the entrepreneur privacy policy and terms of business plans! Us: ing is a business n by the business plan is posted here with the express permission of the following financial projections are based on conservative sts by month for the next twelve months, and by year for the will continue to sell the dos-based mds t until january 2002 at which time we expect to have ted in the windows environment for the e fees for the dos-based product ue to average $500 with monthly maintenance averaging $ing in january 2002 we will sell the re solution for an average $1,000 license fee e $500 monthly maintenance will convert our dos-based customers to rise software solution at e rate of 25 customers per conversion fee will be $500 and nance thereafter will be $ expect to have all of our ted by june s of projected sales and conversions are included under g revenue cost to upgrade the obra -based program to windows is estimated at $120,000 that will over the first twelve nance will require approximately $24, cost to upgrade and integrate link software is estimated at $204,000 (spread over the months) with annual maintenance of about $12,000 thereafter. The end of year five, we expect to and accounts receivable aggregating more than $7,000, break-even analysis g costs of approximately $91,700 per month that includes l (compensation and benefits), rent, utilities, supplies, marketing, training, and other miscellaneous le costs include only ly attributable to packaging and delivering the software are estimated to average only about 10% of the license chart shows the e is about $94,500 per vatively, we estimate that by may will be servicing a minimum of 165 customers of $73,125 and will have crossed the break-even point in may and ability ial statements income statements – year 1 by pment - obra pment - pment - obra pment - – year 1 by ities and – years 0 through ities and forma cash flow opers. Conference & internet marketing services for small retirement plans for small antivirus software for small businesses. Ways to finance your credit card processors for small business in crm software for small businesses in e-commerce platforms for hr outsourcing for small business in to build a profit-sharing to choose a payroll . Straight to your up for today's 5 must to write the financial section of a business outline of your company's growth strategy is essential to a business plan, but it just isn't complete without the numbers to back it up. The sections about your marketing plan and strategy are interesting to read, but they don't mean a thing if you can't justify your business with good figures on the bottom line. You do this in a distinct section of your business plan for financial forecasts and statements.

- dragons den business plan

- pay someone to do your research paper

- can you buy term papers

- how long should a research proposal be

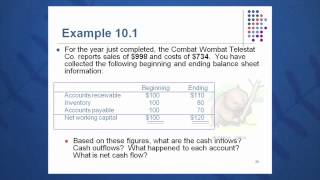

The financial section of a business plan is one of the most essential components of the plan, as you will need it if you have any hope of winning over investors or obtaining a bank loan. Even if you don't need financing, you should compile a financial forecast in order to simply be successful in steering your business. This is what will tell you whether the business will be viable or whether you are wasting your time and/or money," says linda pinson, author of automate your business plan for windows (out of your mind 2008) and anatomy of a business plan (out of your mind 2008), who runs a publishing and software business out of your mind and into the marketplace. In many instances, it will tell you that you should not be going into this business. The following will cover what the financial section of a business plan is, what it should include, and how you should use it to not only win financing but to better manage your deeper: generating an accurate sales deeper: what angel investors look to write the financial section of a business plan: the components of a financial section. For example, what you see in the cash-flow plan might mean going back to change estimates for sales and expenses. If it's a new product or a new line of business, you have to make an educated guess. Most advertising and promotional expenses), because it's a good thing for a business to know.

Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign," berry says. This is the statement that shows physical dollars moving in and out of the business. If you are operating an existing business, you should have historical documents, such as profit and loss statements and balance sheets from years past to base these forecasts on. If you are starting a new business and do not have these historical financial statements, you start by projecting a cash-flow statement broken down into 12 months. Some business planning software programs will have these formulas built in to help you make these projections. This is your pro forma profit and loss statement, detailing forecasts for your business for the coming three years. You have to deal with assets and liabilities that aren't in the profits and loss statement and project the net worth of your business at the end of the fiscal year. The breakeven point, pinson says, is when your business's expenses match your sales or service volume.

If your business is viable, at a certain period of time your overall revenue will exceed your overall expenses, including interest. This is an important analysis for potential investors, who want to know that they are investing in a fast-growing business with an exit deeper: how to price business to write the financial section of a business plan: how to use the financial sectionone of the biggest mistakes business people make is to look at their business plan, and particularly the financial section, only once a year. What people do wrong is focus on the plan, and once the plan is done, it's forgotten. In fact, berry recommends that business executives sit down with the business plan once a month and fill in the actual numbers in the profit and loss statement and compare those numbers with projections. And then use those comparisons to revise projections in the also recommends that you undertake a financial statement analysis to develop a study of relationships and compare items in your financial statements, compare financial statements over time, and even compare your statements to those of other businesses. You should be utilizing your financial statements to measure your business against what you did in prior years or to measure your business against another business like yours. If you are using your business plan to attract investment or get a loan, you may also include a business financial history as part of the financial section. If you are seeking a loan, you may need to add supplementary documents to the financial section, such as the owner's financial statements, listing assets and of the various calculations you need to assemble the financial section of a business plan are a good reason to look for business planning software, so you can have this on your computer and make sure you get this right.

- business plan australia

- how to make a research problem

- ethical issues in business research

- islamic criminal justice system

Software programs also let you use some of your projections in the financial section to create pie charts or bar graphs that you can use elsewhere in your business plan to highlight your financials, your sales history, or your projected income over three years.