Market research price

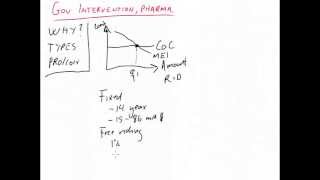

Books & white to use market research to determine product caitlin stewart, on january 7, ng on a price for a product or service is one of the most important decisions for any organization. Because companies need to cover their costs, it is vital that the price of an item is high enough to cover expenses, but not so high that customers won’t be willing to pay for the product. There are many market research techniques that are important to determine the best price point for any given most basic market research pricing strategies include the following:Conjoint analysis is one of the main research techniques for determining price. When conducting price analysis with this process, researchers determine what customers give up by paying a certain price for a product and compare that against the features the customer is gaining by purchasing the product. By determining how customers make their purchasing decisions, the economic impact of price changes can be conjoint analysis provides price sensitivity and allows researchers to create a market model to determine what price changes will have an effect on or not -granger is basically direct marketing. When using this method, customers are asked whether they would buy a product at a particular price. Then, the price is changed, and the customer is again asked if they would purchase the product. Then, demand can be determined once a price point is biggest issue with this strategy is that customers may understate or overstate the price they are willing to pay for a product. Also, determining what your customers will pay for a product, then setting that price may not keep up with the competition, particularly if the competition is offering the product for van westendorp strategy is also a direct pricing method. Then, these prices are plotted, and the area between is used to determine the range of acceptable van westendorp method removes a competitive element from determining prices, and it assumes that customers know what the market situation is. In addition to these strategies, organizations can use competitive intelligence from syndicated market research reports to determine competitors’ successes and failures to help determine what pricing strategies attract, or deter, customers as a compliment to their own g research er research product er tative market research nt analysis g research and pricing g is one of the more technical areas of market research. The aim is not to find what customers like, but what they are willing to pay and so what the optimum price point is to maximise profit or revenue or market share. There are four main approaches to pricing research, the gabor-granger technique, van westendorp price sensitivity monitor, brand price trade-off and conjoint analysis (also known as discrete choice analysis). Some techniques can be used off-the-shelf and many companies sell branded pricing research packages that are just a variation on one of these techniques, however selecting the right technique ultimately depends on what the problem is you are trying to context, positioning and price strategy are also extremely important in setting prices - what are you trying to do with your prices - eg win share or maximise profits? In business markets "value-in-use" or "total cost" may be more important than absolute modelling and market models are a fundamental part of pricing research to estimate demand optimum points and competitor responses.

Cost of market research

The findings will certainly help shape our thinking in this area and we now have a view of pricing that far extends our knowledge in the market place. Granger pricing research is named after the economists who invented it in the 1960s and is also know as direct pricing. Customers are asked to complete a survey where they are asked to say if they would buy a product at a particular price. From the results we can work out what the optimum price is for each individual. By taking a sample of customers we can work out what levels of demand would be expected at each price point across the market as a whole (the demand curve in the following graph). Using this estimate of demand, the price elasticity (or expected revenue) can be calculated and so the optimum price-point in the market established. Weakness of gabor granger is that customers may understate the price they will pay (there are also circumstances in which they will overstate the price). Competitive response to different prices cannot be gauged from gabor granger and knowing customers what would pay is useful, but not if competitors are offering the same product for less. There are a variety of ways of asking the questions including asking for a price directly, or asking for a rating of likelihood to buy. Respondents are asked four questions to determine what prices are too cheap, where a price is a bargain, when a price is expensive and where a price is too expensive. By plotting the cumulative curves for each of the four prices, the crossing points are deemed to be optimum points - for instance where the expensive and bargain price curves cross the resultant price "space" helps to determine the range of acceptable prices - and so pricing tactics - available. This is a technique which is more for price positioning type studies than for estimating optimum pricing. As with the gabor granger, there is no competitive element and it assumes respondents know the market. It also gives no direct measure of likelihood to buy, so the van westerndorp is often combined with direct pricing questions, or with a main major technique for pricing is based on conjoint analysis and is more sophisticated and more reliable than other research techniques. Conjoint is excellent at looking at understanding how choices are made and consequently the importance of price.

For some, conjoint analysis is the only way of carrying out pricing research, and in particular discrete choice analysis (a subset of conjoint) is often used to estimate price elasticities for brands in supermarket style layouts. However, conjoint analysis is a more technical form of research and requires higher levels of design skills. If pricing is to be conducted it is often advantageous to include it as part of a broad conjoint study into product and service conjoint analysis, customers trade off price against other product features, or in discrete choice analysis, price against brand alone. By looking at how customers make decisions, economic impact of price changes can be assessed as can 'balanced-value' positions for price positioning. Key output from the conjoint analysis is not just what the measures of price sensitivity are, but also a market model that can be used to investigate both what the optimum is if nothing changes, but can also investigate competitor response and potential profitability by building in fixed and variable costs. In more dynamic pricing models such as transportation or leisure markets, these models can be used by yield managers to help guide ticket 'buckets' for time sensitive price trade-offs (bpto). Brand specific studies measures of brand equity and category management brand price trade-off studies (bpto) can be used. Here customers evaluate a range of products and prices are adjusted until customers stop oural price research approaches assume that pricing is dealt with in a rational manner. Increasingly behavioural economics shows that reactions to prices can be conditioned by other factors and the structure and presentation of pricing options will affect choice. Factors like anchoring (using one price to judge a second price) and framing can be important, particularly in product ranges where there are both price per item, but also relative prices between different products to be some markets where prices are very visible, or where there is a large amount of internal pricing data, it is possible to use econometric methods to examine the impact of price and to understand price elasticities. Using pricing tests, discounts and advanced statistical analysis the impact of price can be assessed live in the real most common approach to pricing research is to rely on market intelligence and follow-my-leader type pricing using a competitor as a benchmark. Statistically speaking, where you are looking to optimise prices where you are looking at relatively small price changes of 5-10%, you will need larger than normal sample sizes to get the statistical accuracy you need. For many companies this can make pricing research expensive, unless combined with a range of other is also important to consider psychological effects like anchoring in price research. The price-range shown and the first values shown can influence perceptions of what is appropriate, or cheap or expensive, particularly in markets where prices are largely unknown such as infrequently purchased or specialist general qualitative research is not recommended for pricing studies. Qualitative research can be useful when a price list or price structure has become too complex, but in general when you ask people about prices in a qualitative setting, prices are always too high, or not transparent, and respondents will tend to negotiate with the researcher so it is not possible to produce estimates of demand at different price ting the market to provide a more tailored tanding and using brand price trade conjoint to understand the trade off's your customers » best practices & how-to » let’s talk price: how much does research cost?

Number of factors need to be considered before i can answer the question about how much research costs, because everyone has different needs. When i’m asked about the price for a focus group, or in-depth interviews, or a survey, i naturally need to know what you want to achieve through the research, who you want to ask the questions of, and how you plan to act on the results. Your budget range is important, too – not because i intend to raise the price to fit the top of that range, but to ensure i properly scope the project to best meet your needs given the priorities and constraints you er the price of a focus group study. That’s why, to get to a precise price, any market research firm worth its salt needs to ask you a battery of questions. The people you want participating in the study is the single biggest price driver: it takes far more time and effort to recruit – and therefore costs much more to interview – a lieutenant general or fortune 500 ceo than it does to speak to a high school are some other price-related issues affected by the target audience:The budget depends on the number of audience types you are targeting and whether it makes sense to mix them into the same group or give them their own group to ensure an unbiased and more relevant discussion. This can affect the price dramatically, depending on who the target the target audience very senior, or a very specific and hard-to-reach segment? And on top of that, the type of recording, analysis, reporting, participant incentives and travel will impact the budget as sely, the price for quantitative research can range widely, from $15,000 to over $100,000, with most studies in the $30,000-$55,000 these cases, you need to consider several issues:The target audience(s) you want to survey. Your goals and the number of targets may require us to slice and dice the data when we analyze the results, and since we’ll need to ensure each subgroup contains enough completed surveys to run a statistical analysis, this will drive the number of surveys required and thus drive the price. It may sound daunting, but by going through this exercise up-front you will benefit from a much more focused research effort, eliminate misunderstandings along the way, and get the value you brings me back to the price of the car you want. But if you go off-roading in the sahara, your car will need additional capabilities and you may want additional amenities to be comfortable in that harsh environment, all of which are likely to drive the price significantly higher. The same principles apply to market research where pricing is discuss a custom solution with our trained experts, please contact mari canizales coache at 703-378-2025 or via email. Privacy ms we solvelatest research & infographicsclient worktoolsbest practices & how-toblogabout us▼servicescase studiescertificationsgovernment contractsfaqscareerscontact usteamnews & events▼in the newsupcoming eventspast eventspress releasespodcastsvideoswebinarsnewsletterscontact company newsmarket pulseresearch instantsurvey quote. Highlights: the latest upgrades for research to write a great survey – aytm report: top innovators, and some revealing disagreements on research’s your personality type reveal your preferred presidential candidate? Strategy: finding your price with market of the most difficult decisions to make when launching a new product is determining a price. Finding the balance between too low and too high can be tricky, and doing the survey research for these decisions can be even harder.

- how to write a composition paper

- motivationsschreiben fur arbeit muster

- motivationsschreiben fur arbeit muster

There are several a new market research study, and get the valuable answers you need, with beautiful survey design built in automatically. As a market research company, we at aytm are here to help you quickly and easily test ideas for your new company, product, service, or homework assignment. However, some researchers advise against this approach because after the second screen your respondents will anticipate another drop, and vote artificially low in the current screen expecting you’ll go even lower in the next. In our toothpaste example, for a particular tube and brand, they would model how demand varies by price. The cpg companies and other large businesses do exhaustive quantitative research, sometimes using a technique called conjoint analysis. It’s a technique that requires working with a statistician or market research firm to do the analysis for pricing the simple approach concerns you due to likely skew, and hiring a statistician isn’t an option, there are ways to do your own pricing research. These options will give you some great information to work with as you decide how to price your product, without spending hundreds of thousands of c design is a common approach in market research surveys for pricing strategies. It’s where we ask people to indicate their interest in a particular product at a particular price point. In group a’s survey, they are exposed to the product at one price level, group b sees a totally different price, and group c sees yet a third. We can do this easily in aytm by cloning one survey design and modifying that single question to include a different price r advantage of the monadic approach, aside from avoiding anticipatory responses, is that it saves space so that you can ask other questions. We don’t want an overly long survey, but often when you have the opportunity to talk to people to test price, you have other things you’d like to ask them too. But if you have several questions just abut price, then you won’t have a whole lot of time to ask other burning alternate approach is to do a variation of conjoint analysis. A allows you to understand whether there are certain feature combinations that will command a price premium. Be realistic and use only likely combinations to gauge possible purchase sensitivity meter / van price sensitivity meter experiment (psm or van westendorp) is a very efficient method to predict a price range/optimal price perception for a new product or service. We recommend using psm as a directional tool, or as a first step of price research, followed by a more precise methodology such as a monadic price presents each respondent with the question “for [product/service], at which point would you consider the price to be…”, along with the following 4 prewritten subquestions.

The respondent is prompted to type a price answer for each:• so cheap that you would think it couldn’t be a quality product/service. So expensive that you wouldn’t consider purchasing your survey is fulfilled, you will have a clear visual representation of the acceptable price range and optimal price point according to the cumulative prediction of respondents’ price test is based on graph theory, and features more accurate intersection calculation formulas than are commonly used in the ng a pricing strategy should never be done in a vacuum. Responses to pricing strategy: finding your price with market ck: ppc tips | social media tips | creative 404 error pages | diamond website ber 30 2013 at 6:10 ber 30 2013 at 6:34 r 28 2013 at 5:42 you have any tips on how to find price quotes for products from big companies? For me, the companies i’m researching keep their prices private and i don’t know if i’m allowed to ask for price quotes (as a competitor, not a customer).